carried interest tax concession

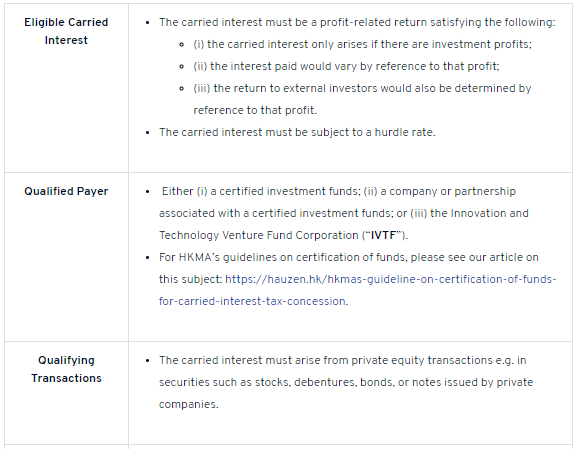

A qualifying payer is any of the following. Qualifying carried interest broadly includes carried interest received from gains from investments in private companies.

Hong Kong Tax Treatment Of Carried Interest Kpmg United States

The legislative council brief accompanying the Bill specifies that carried interest derived from a hedging transaction may only be eligible for the Tax Concession if the hedging transaction forms part and parcel of the private equity transaction and the profits on the hedging transaction are embedded in the profits or loss on such transaction for the calculation of.

. On 7 May 2021 the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance came into operation introducing the much-anticipated Carried Interest Tax Concession Regime the Regime. Specifically the carried interest must arise from a tax-exempted qualifying transaction in the shares stocks. Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021.

Transactions in the shares stocks debentures loan stocks bonds or notes of or issued by a private company as well as transactions incidental to the carrying out of such transactions provided that they do not exceed 5 of total trading. Following the governments consultation paper issued in August 2020 and the industry consultation on the initial proposals the Legislative Council LegCo Panel on Financial Affairs released a discussion paper on 4 January 2021 on. Given tax treatment is one of the key factors influencing the choice of jurisdiction for fund domiciliation and operations it is announced in the 2020- 21 Budget Speech that the Government plans to provide tax concession for carried interest distributed by PE funds operating in Hong Kong.

The Regime operates to provide tax concession at both the salaries tax and profits tax levels. The Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 Ordinance was enacted into law on 7 May 2021 by way of amendment to the Inland Revenue Ordinance IRO. Eligible Carried Interest will be taxed at 0 profits tax rate.

Hong Kong enacted the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the New Law on 7 May 20211 The New Law provides a tax regime offering tax incentives for eligible carried interest of qualifying persons and qualifying employees. Applying retrospectively to tax years commencing on or after 1 April 2020 the Amendment Ordinance has essentially transformed Hong Kong into one of the most tax efficient jurisdictions for fund. A tax concession is proposed for carried interest issued by private entity PE funds operating in Hong Kong.

The concessional tax treatment for carried interest is now effective from 1 April 2020 and will provide for a 0 tax rate for qualifying carried interest. 11 rows As part of a longstanding Government policy to attract private equity PE and investment fund. January 11 2021.

The New Law applies to eligible carried interest received or accrued on or after 1 April 2020. The tax concession involves a number of conditions that must be satisfied for a carried interest to qualify for the concession. After six months of consultation the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 Bill providing for a tax concession for a 0 profits tax rate on eligible.

A private equity fund typically uses carried interest to pass through a share of its net capital gains to its general partner which in turn passes the gains on to the investment managers figure 1. A fter years of lobbying with the government of the Hong Kong Special Administration Region Hong Kong SAR government and the Hong Kong Inland Revenue Department IRD the tax concessions for carried interest are now effective retrospectively from April 1 2020. Tax concession rate The Proposal provides that eligible carried interest would be charged at a 0 profits tax rate such rate was kept silent under the Consultation Paper.

The managers pay a federal personal income tax on these gains at a rate of 238 percent 20. They provide for a 0 tax rate for qualifying carried interest further to the. The preferential tax rate is especially important for a private equity fund and its managers.

Furthermore the Proposal clarifies that 100 of eligible carried interest would also be excluded from the employment income for the calculation of the investment professionals salaries tax. As a prerequisite to the concessionary tax regime the eligible carried interest must arise from profits on the in-scope transactions 2 of private equity PE funds which are exempt from profits tax under the Unified Fund Exemption Regime UFR. Under this new concession eligible carried interest received or accrued on or after from 1 April 2020 will be subject to zero percent profits tax.

Following its proposal to introduce a concessionary tax rate for carried interest earned from Hong Kong private equity funds on January 4 2021 the Hong Kong Government announced that eligible carried interest will be charged at a profits tax rate of 0 and that 100 of eligible carried interest will be excluded. These include being a qualified recipient the need to comply with headcount and operating expenditure substance requirements as well as the need for the fund be certified by the Hong Kong Monetary Authority and the Inland Revenue. The tax concession regime for carried interest distributed by eligible private equity funds operating in Hong Kong alongside the enhancements to the profits tax exemption that was initially introduced in April 2019 offer additional strong incentive and an attractive tax framework for fund operators to establish and operate private equity funds in Hong Kong while.

The Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 Ordinance was enacted into law on 7 May 2021 by way of amendment to the Inland Revenue Ordinance IRO. Eligible carried interest recipients. On 7 May 2021 the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 the Amendment Ordinance was enacted into law.

With some expectation a gain on an investment in a public company or from any other non. Carried interest tax concession - conditions Must be paid by a qualifying payer The carried interest must be paid by a certified investment fund ie. The Government has spared no efforts in developing Hong Kong as a premier PE fund hub.

The tax concession is limited to carried interest distributed in respect of transactions that meet the following criteria. Received a preferred return at an annual rate of 6 compound interest that would also be considered carried interest. Under this new concession eligible carried interest received or accrued on or after from 1 April 2020 will be subject to zero percent profits tax.

At the meeting of the Executive Council on 26 January 2021 the Council ADVISEDand the Chief Executive ORDEREDthat the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the Bill at Annex A should be introduced into the Legislative Council LegCo to. Only carried interest distributed out of tax-exempted qualifying transactions in private equity investments ie shares stocks debentures loan stocks funds bonds or notes of or issued by a private company under Schedule 16C of the Inland Revenue Ordinance would be eligible for the tax concession. The proposal states that the tax concession only applies to carried interest distributed by PE transactions only.

Asset Management Tax Update Kpmg China

Proposal On Hong Kong S Carried Interest Tax Concession Regime Lexology

Dentons Hong Kong Carried Interest Tax Concessions For Private Equity Fund Operators In Hong Kong Enacted As Law Retrospective Effect From April 2020

New Tax Breaks A Magnet For Private Equity Funds The Standard

Asset Management Tax Update Kpmg China

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

Hong Kong S Carried Interest Tax Concession Zero Tax Insights Proskauer Rose Llp

Hong Kong S Tax Concession For Carried Interest Getting Funds Certified With The Hkma

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

Carried Interest Tax Concession Regime For Private Equity Funds Lexology

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds

A New Era For Carried Interest In Hong Kong Kpmg China

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds

Pwc Cn Publication More Good News Carried Interest Tax Concession